FICO Scores Are Not Fixed Estimates of Credit Risk

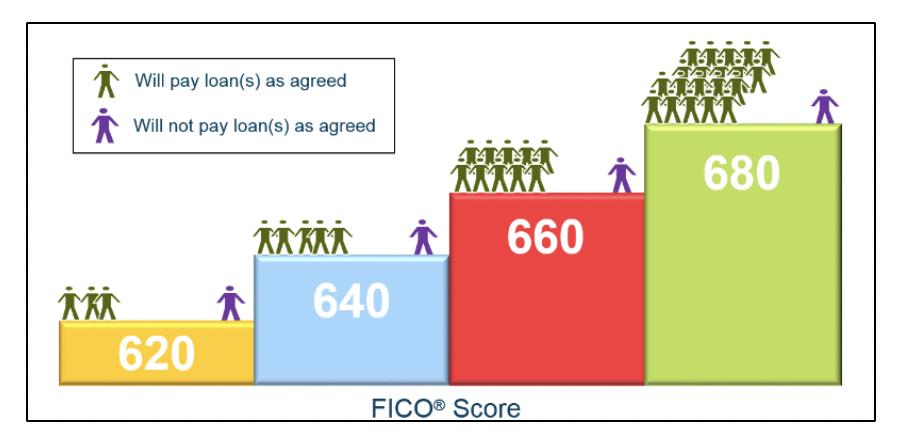

The FICO® Score is designed to rank-order the likelihood that a borrower will repay their loan(s), with higher scoring borrowers representing lower risk, and lower scoring borrowers representing higher risk. The aim of the FICO® Score is to ensure that a pool of borrowers scored as a 660 at a given point in time represent lower risk of default than a pool of borrowers scored as a 620 at that same point in time. Figure 1 provides a conceptual example of this: for every one borrower at a score of 660 that goes on to not pay their loan as agreed, there are 10 borrowers at that score level that will. This 10:1 odds of repayment at a 660 is more than triple the odds of repayment of 3:1 at a 620.[caption id="attachment_38205" align="alignnone" width="581"] Figure 1. FICO® Score is designed to rank order credit risk (purely illustrative data).[/caption]Note the use in the paragraph above of the phrase “at a given point in time”. As covered here, the relationship between repayment odds and the FICO® Score can and does shift over time, largely driven by shifts in factors outside the credit file that also play an important role in consumers’ ability to pay their credit obligations. As noted in the section “Risk in Bankcard Originations on the Rise” here, this relationship is currently trending downwards for certain products such as bankcards, such that repayment risk at a given FICO® Score is higher than it was several years prior. FICO has for many years closely tracked trends in the odds-to-score relationship, and advocated lenders to do the same on their portfolios in case the findings merited an adjustment in underwriting criteria such as the FICO® Score cutoff used. The Federal Reserve, OCC and FDIC have all recognized the importance of such careful monitoring, and issued regulatory guidance (SR 11-7 and OCC 11-12) that requires lenders to validate their models annually.

Figure 1. FICO® Score is designed to rank order credit risk (purely illustrative data).[/caption]Note the use in the paragraph above of the phrase “at a given point in time”. As covered here, the relationship between repayment odds and the FICO® Score can and does shift over time, largely driven by shifts in factors outside the credit file that also play an important role in consumers’ ability to pay their credit obligations. As noted in the section “Risk in Bankcard Originations on the Rise” here, this relationship is currently trending downwards for certain products such as bankcards, such that repayment risk at a given FICO® Score is higher than it was several years prior. FICO has for many years closely tracked trends in the odds-to-score relationship, and advocated lenders to do the same on their portfolios in case the findings merited an adjustment in underwriting criteria such as the FICO® Score cutoff used. The Federal Reserve, OCC and FDIC have all recognized the importance of such careful monitoring, and issued regulatory guidance (SR 11-7 and OCC 11-12) that requires lenders to validate their models annually.Shift in Odds to Score ≠ Score Inflation

Evidence of a changing relationship between the FICO® Score and repayment odds is not evidence of score inflation. It is likely indicative of a shift in the aforementioned factors outside the credit file that also play an important role in consumers’ go-forward risk of repayment. So what are some of these factors?- Macroeconomic conditions such as unemployment rate and Housing Price Index (HPI) changes.

- Lender underwriting practices, such as underwriting borrowers with higher debt-to-income ratios, lower down payments, or lengthier repayment periods---none of these practices can be identified in the traditional credit bureau file.

An Effective Rank Ordering Tool Through The Cycle

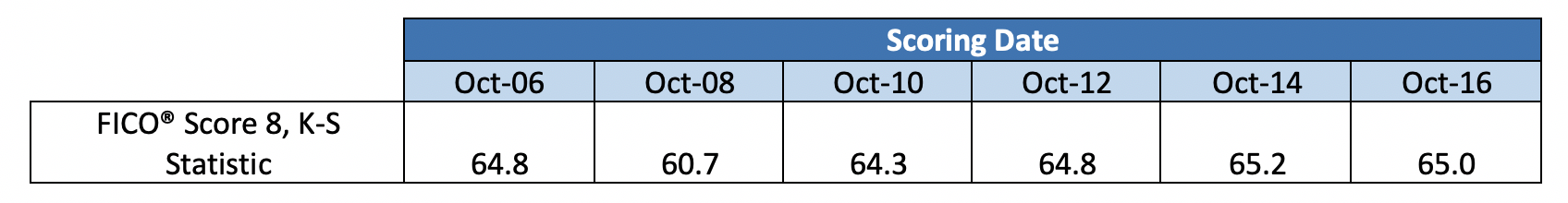

We regularly track FICO® Score dynamics and consistently observe that it is highly effective at rank ordering consumer repayment risk (what it is designed to do) through different economic cycles and underwriting environments. If anything, recent validations indicate that the FICO® Score is actually more effective at differentiating the repayment likelihood of low and high scorers than it was 10 years ago. Figure 2 below shows the Kolmogorov-Smirnov (K-S)* statistic---a widely used measure of the rank ordering effectiveness of a predictive model---calculated for the FICO® Score 8 model over the past decade. As shown, the K-S of the FICO® Score has been very stable over the past 6+ years, and is slightly higher today than it was 10 years ago.[caption id="attachment_38206" align="alignnone" width="661"] Figure 2. FICO® Score 8 Kolmogorov-Smirnov (KS) Statistic on Existing Accounts (All Products) Over Time; ‘defaulters’ defined as 90+ dpd accounts over 24 month outcome period subsequent to Scoring Date.[/caption]FICO® Scores have improved for many consumers over the past 10 years. What has driven the improvement in national average FICO® Score over that period is improvement in the underlying consumer credit data. We have observed fewer credit blemishes and higher available credit lines (which can serve as safety nets in times of temporary financial strain), both of which reflect improving consumer financial health as would be expected during a period of economic expansion. While the relationship between the FICO® Score and repayment odds can and does continue to shift, prudent lenders and investors who leverage the full breadth of information available to them as they assess borrower credit risk are well-positioned to navigate the road ahead.*This statistic is the maximum difference between the cumulative distributions of non-defaulters and defaulters. A zero value indicates that the credit score fails to differentiate between defaulters and non-defaulters; a value equal to 100 indicates that the credit score perfectly differentiates defaulters from non-defaulters

Figure 2. FICO® Score 8 Kolmogorov-Smirnov (KS) Statistic on Existing Accounts (All Products) Over Time; ‘defaulters’ defined as 90+ dpd accounts over 24 month outcome period subsequent to Scoring Date.[/caption]FICO® Scores have improved for many consumers over the past 10 years. What has driven the improvement in national average FICO® Score over that period is improvement in the underlying consumer credit data. We have observed fewer credit blemishes and higher available credit lines (which can serve as safety nets in times of temporary financial strain), both of which reflect improving consumer financial health as would be expected during a period of economic expansion. While the relationship between the FICO® Score and repayment odds can and does continue to shift, prudent lenders and investors who leverage the full breadth of information available to them as they assess borrower credit risk are well-positioned to navigate the road ahead.*This statistic is the maximum difference between the cumulative distributions of non-defaulters and defaulters. A zero value indicates that the credit score fails to differentiate between defaulters and non-defaulters; a value equal to 100 indicates that the credit score perfectly differentiates defaulters from non-defaultersThe post Are FICO Scores “Artificially Inflated?” appeared first on FICO.

Show More

Rate

Join Podchaser to...

- Rate podcasts and episodes

- Follow podcasts and creators

- Create podcast and episode lists

- & much more

Episode Tags

Do you host or manage this podcast?

Claim and edit this page to your liking.

,Claim and edit this page to your liking.

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2024 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us