Our interest rates are still historically low. If you wait to buy a home, you’d be missing out on a golden opportunity to save money in the long run.

Buying a home? Click here to perform a full home searchSelling a home? Click here for a FREE Home Value Report

In case you haven’t heard, we’re still experiencing historically low interest rates. Right now, if you look at all the different types of financing, our interest rates are hovering around 3.6%. What can you do about it? How are they affecting your purchasing power?

First, you must know that these rates are not going to stay around forever. When I first got into the business—nearly 30 years ago—I remember that they were trending around 8%, 9%, and 10%. My parents had it worse when they were buying houses—they had to deal with rates as high as 15%!

To demonstrate the purchasing power our current rates offer and what it means to you if you wait and miss out on this opportunity, take a look at the chart below:

As you can see, with a 3.75% loan, your principal and interest payment would be about $1,852 on a $400,000 home. If you go a full percentage point higher to 4.75%, your payment would increase to $1,878. Some experts are predicting that within the next 12 months, our rates could very well rise that full percentage point.

“

Don’t miss out on these historically low rates.

”

How does this affect the purchase of the house? Essentially, for the exact same payment, your purchase price goes down by 10%. You’re no longer looking at a $400,000 house for that same payment; you’re looking at a $360,000 house. You would be buying less home for the same monthly payment just for that 1% increase.

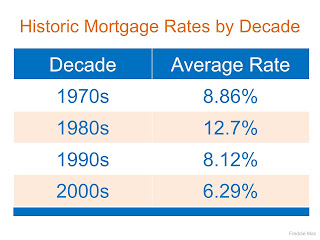

Here’s another chart for historical reference: As you can see, back in the 1970s, we were close to 9% for an average rate. In the 1980s, we were at almost 13%. In the 1990s, the average dipped down to close to 8%. Then in the 2000s, it dropped even further to 6.3%. At those times, those rates were considered completely normal.

As you can see, back in the 1970s, we were close to 9% for an average rate. In the 1980s, we were at almost 13%. In the 1990s, the average dipped down to close to 8%. Then in the 2000s, it dropped even further to 6.3%. At those times, those rates were considered completely normal.

Do you see how fortunate we are? Now is clearly the time to buy. Our average prices are up 10% from what they were last year, but that’s missing the point. By buying now, you will pay less over the long run.

If you have any questions about buying or selling a house or you’d like me to run these rates for you at a different price range, please don’t hesitate to give us a call or shoot us an email. We’d be happy to help!

Join Podchaser to...

- Rate podcasts and episodes

- Follow podcasts and creators

- Create podcast and episode lists

- & much more

Episode Tags

Claim and edit this page to your liking.

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2024 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us